Car title loans for seasonal workers offer quick cash access using vehicle titles as collateral, bypassing traditional credit checks and employment verification. Houston and San Antonio lenders assess vehicle value and basic eligibility, aiding those with irregular incomes during off-peak seasons. Key considerations include interest rates, repayment terms, equity impact, and aligning with financial goals.

Looking for quick financial support during your off-peak season? A car title loan could be an option for seasonal workers, even without a traditional pay stub. These loans offer flexibility and accessibility, catering specifically to those with fluctuating incomes. In this article, we’ll explore how these loans work, who is eligible, and the advantages and potential drawbacks. Understand the process, requirements, and benefits before deciding if a car title loan is the right move for your financial needs.

- Understanding Car Title Loans for Seasonal Workers

- Eligibility Criteria: What You Need to Know

- Benefits and Considerations of This Loan Option

Understanding Car Title Loans for Seasonal Workers

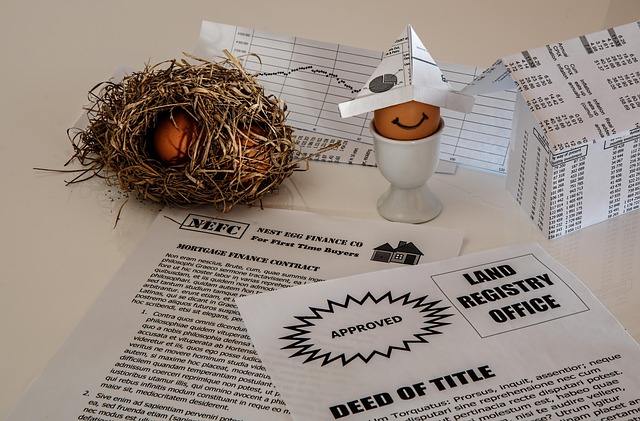

Car title loans for seasonal workers have gained popularity as a convenient solution for those facing financial challenges between seasons. Seasonal workers often experience income fluctuations due to their employment nature, making it difficult to meet immediate financial needs. This type of loan is designed to offer quick access to funds using a vehicle’s title as collateral, regardless of the borrower’s credit history or employment status.

Eligible borrowers can secure a car title loan in San Antonio without the need for a traditional pay stub. Lenders focus on the value and condition of the vehicle rather than the borrower’s income. This alternative financing option is particularly appealing to seasonal workers who may not have steady employment but still require emergency funds or support during their off-season. A no-credit-check loan process ensures that even those with less-than-perfect credit can access much-needed capital, providing a safety net until their next season of employment.

Eligibility Criteria: What You Need to Know

Car title loans for seasonal workers offer a unique opportunity for those who need quick access to cash during peak seasons but may struggle with traditional loan applications due to irregular income. These loans are designed to cater to the specific needs of seasonal workers, allowing them to borrow money using their vehicle’s title as collateral. Unlike many other types of loans, car title loans do not require a pay stub or extensive credit history for eligibility.

To qualify for a car title loan in Houston or elsewhere, borrowers typically need to meet certain basic criteria. Lenders will assess the value and condition of your vehicle, ensuring it meets their minimum requirements. Additionally, you must hold a valid driver’s license and have proof of insurance for the vehicle. While specific loan requirements may vary between lenders, these flexible terms make car title loans an attractive option for seasonal workers in need of immediate financial assistance.

Benefits and Considerations of This Loan Option

A car title loan for seasonal workers offers a unique financial solution during periods of income inconsistency. Seasonal workers often find themselves in a bind when unexpected expenses arise between paychecks, and this alternative lending option can provide quick access to cash. One of its key advantages is the relaxed eligibility criteria, as it doesn’t require traditional employment verification or a steady stream of income, making it suitable for temporary or gig-based employees.

Considerations for these loans include understanding the interest rates and repayment terms, which can vary among lenders. While some San Antonio loans in this category may offer appealingly fast approval times, ensuring you are comfortable with the entire process is vital. Unlike typical loans, car title loans use your vehicle’s equity as collateral, so it’s crucial to assess if repaying the loan aligns with your financial goals and if you can afford potential penalties for early repayment.

Car title loans can provide a much-needed financial lifeline for seasonal workers who require quick access to cash. By utilizing their vehicle’s equity, these loans offer flexibility and convenience without the stringent requirements of traditional pay stubs. However, it’s essential to weigh the benefits against potential risks, such as interest rates and repayment terms, to ensure this loan option aligns with your individual financial needs.